All Categories

Featured

Table of Contents

Tax sale excess happen when a tax-foreclosed home is cost auction for a higher cost than the owed taxes. The surplus funds, also called overages, are the distinction in between the list price and the tax obligations due. This excess is normally gone back to the initial house owner. If unclaimed, you, as an investor, can help discover and declare these surplus funds for the former property owner for a cost.

If the property owner does not pay their real estate tax, there can be a Tax Repossession by the local county and if that home mosts likely to Tax obligation Repossession public auction, there is commonly a prospective buyer who gets the property for even more than what was owed in property tax obligations. Let me clarify # 2 for you a little deeper say you owe $15,000 in real estate tax on your residence and your building goes right into Tax obligation Repossession.

Claim the building sells for $100,000 and from that, the area takes their $15,000 they were owed for home tax obligation. What takes place to the remaining $85,000 that the staff of court has in their financial institution account? The property owner has to make a case to the area staff and the court generally evaluates these cases and honors the homeowner his cash.

The area federal government HAS NO commitment to inform or inform the previous home owner. J.P. Morgan says these Tax obligation Repossession sales create nearly 13.6 million bucks in excess, or equity, every day. It's incredible! They do NOT tell the former proprietor this equity results from them since if it's not gathered, the federal government obtains to maintain that cash after a taken care of quantity of time.

My friend, Bob Diamond, is a professional in this specific niche of excess and helps property owners get the cash that results from them. He just recently told me that they currently have 2.2 million bucks in excess under agreement in his workplace and they will certainly get fees of roughly 30% of that 2.2 million.

Delinquent Tax Homes For Sale

There are a couple of things you will certainly require to be effective in the excess organization. Below are the four simple actions you will need to follow: Find out who is owed the cash and who to obtain a targeted list. Due to the fact that Bob is a lawyer, he understands exactly how to obtain the listing needed to find these previous homeowners.

The excess market is a fantastic area for a real estate rookie to start their occupation. Beginning with tax obligation sale overages, and then function your method up to a lot more complex funds like mortgage foreclosure overages and unclaimed estates.

This is additionally a terrific method for a person that doesn't wish to purchase and offer homes any longer to stay in the real estate market without getting their hands too unclean. Bob describes this as the "Robin Hood System" and if you assume around, this name absolutely makes feeling. There is a significant amount of cash in it for YOU as an expert who would certainly be locating this cash for individuals from the federal government.

Discover innovative software application services for tax sale overages and maximize your financial gains. Software for this, software program for that. Invite to business globe today. Every little thing focuses on the most effective tech readily available to make job easier and much faster. One area where some ingenious software remedies can go a long method is the globe's tax obligation sale excess.

Before that, what are tax sale excess? Albert still requires to pay building taxes on his condor, and currently he owes Uncle Sam a whooping USD$ 20,000.

Back Taxes Houses For Sale

There are many avenues for you to tip right into and make a killing. Below are a few. As the legislation goes, Albert can declare this excess. However he's not got for life. After a specific duration, Uncle Sam may just make a decision to maintain it if Albert is a no-show. So, how regarding you stand for Albert and see to it he obtains what's rightfully his (and you, rightfully yours) Tax obligation liens are those legal claims troubled property for unpaid real estate tax.

Claim, you've obtained a client, Albert. Your work is to take him through the lots of lawful treatments. The point? To guarantee he recognizes his rights and the steps he requires to require to recover overages. What's in it for you? Initially, your successful customers tell their good friends you're "those people you most likely to when you want your overages".

In addition to the win, there's likewise the cut you had actually chosen with Albert to deal with the lawful expenses. Information whiz free? Pull your inner Edward Tufte ideal, and you'll make a name (and dollars) in the tax sale excess scene. Photo this: you uncover a cluster of prime residential properties ripe for the picking.

Tax Lien Foreclosed Properties

Would like to know just how to do it ideal? Think about registering in trusted realty investing programs - how to stop a tax sale on your property you enjoy and hop on the road. These programs? They can go a long method in preparing you for the numerous opportunities worldwide of tax obligation sales. These are some ways to go far on your own in the tax sale overages scene.

Lots of devices are out there to help you get over the leading quicker. Looking to get this? Certain, recognizing your things matters, but the marvels that come with great tech can really get things rolling.

Property Sold At Tax Sale

Imagine an electronic radar, always on, catching every blip in the home and tax sale world. You're always in the loophole, never ever missing a beat (or an overage chance). You get it all in one easy-to-access layout.

An upcoming big sale that you should be ready for? You've got it. A due date by which Fancy need to have gotten her excess is coming close to.

Tracking potential excess? Handling insurance claims? Less time crunching numbers, more time attracting up those techniques to boost business bottom line.

Time saving? Yes. Improved precision? On the menu. When you're out in the software application market, believe regarding obtaining them. Pick just the most effective for your company. You're handling Uncle Sam and the tax globe. Being on the straight and slim is non-negotiable. That's why obtaining a compliance tracking system is a wonderful idea.

It's job? Make certain you're dotting the I's and going across the T's on every offer. Say goodbye to sleepless evenings stressing concerning stepping on lawful landmines. Insights work. That's why companies all over the world invest billions of dollars yearly to obtain them. You're no exception. Excellent understanding is like having a clairvoyance that shows you the past and existing and provides you slip peeks right into future fads.

Paying Other People's Property Taxes

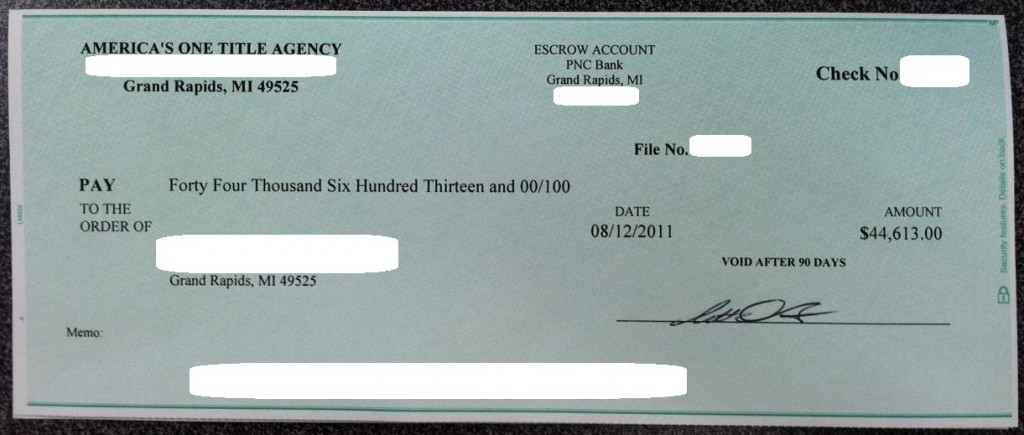

Many services around don't. These platforms transform hills of data right into gold mines of insights, assisting you make wise, educated choices. So, you've dipped your toes right into the realty pool and stumbled upon a found diamond. A residential property's been auctioned off for USD$ 150,000, however think what? The tax obligation bill was just USD$ 50,000.

They're an awesome way to take care of conversations with the previous property proprietor. Every phone call you made? It's like having an individual assistant maintaining tabs on every call, e-mail, and handshake deal.

Latest Posts

Houses Sold For Back Taxes

How To Invest In Tax Lien Certificates

Tax Lien Investing Scams